|

|

||||

|

||||

|

|

||||||||||||

|

||||||||||||

Our News

| 17/09/2025 | ||

While Foreign Relations Dept. Manager. revealed to Manbar Al-Akhbar website the reason behind this: "A new banking success...National Bank of Yemen takes the lead locally and advances globally." |

||

|

||

| Exclusive/News Platform | ||

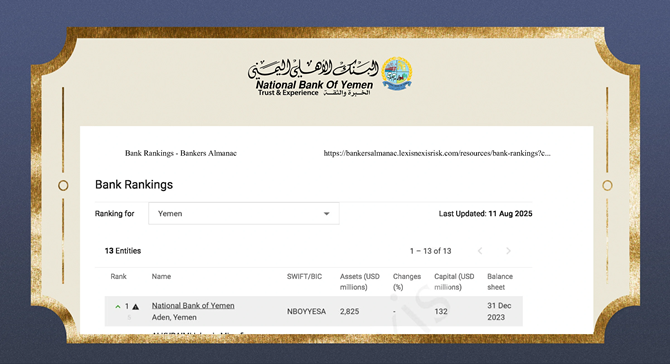

| National Bank of Yemen achieved a remarkable banking achievement after heading to first place locally, according to the quarterly report issued by Bankers Almanac on August 11, 2025, advancing from fifth place, which it held on April 26 of the same year. Globally, National Bank of Yemen jumped 1,143 places, rising from 3,661st to 2,518th, due to the significant growth in its financial indicators. Total assets increased from $1,582 million in 2022 to $2,825 million in 2023, while capital increased from $80 million to $132 million during the same period. This progress reflects the strategic efforts of the bank's senior management, led by Dr. Mohammed Hussein Halboob, Chairman of the Board of Directors, Dr. Ahmed Ali Omar Bin Sankr, General Manager, and the Deputy General Managers, who focused on supporting digital transformation, developing human resources, and enhancing the sustainability of banking services to keep pace with global changes. Banking experts confirm that this achievement enhances international partners' confidence in National Bank of Yemen as a stable and reliable financial institution capable of efficiently managing risks and providing innovative banking services, contributing to building strong and sustainable relationships with correspondent banks and partners in global markets. Saber Saeed Al-Sharmani Manager, Foreign Relations Dept.at National Bank of Yemen, told Manbar Al-Akhbar website ,that National Bank of Yemen’s first place locally and its global advancement in the Bankers Almanac classification is the result of integrated work between the bank’s leadership and its staff, and an embodiment of our commitment to international standards in banking. He noted that this achievement reflects the strength of the bank's financial position and the confidence of our local and international partners. It motivates us to continue developing our services to keep pace with economic and technological transformations, and enhances the bank's position as a leading national financial institution, both locally and internationally. |

||

| Evaluation of the National Bank of Yemen among Yemeni banks | ||

| National Bank of Yemen's rating among international banks | ||

| BANK RANKINGS | ||

| Click here to view the image in its full size. | ||

|

||

| 17/09/2025 | ||

The National Bank of Yemen ranked first among Yemeni banks for the year 2023, according to the international company "Bankers Almanac." |

||

|

||

| Aden/Exclusive: | ||

| In a new achievement adding to its ongoing successes, the National Bank of Yemen announced its ranking as the top Yemeni bank for 2023, according to a report issued by the prestigious global ratings company, Bankers Almanac. This achievement is the culmination of the National Bank of Yemen's ongoing efforts to develop its banking performance and advanced services, and its commitment to the highest standards of governance and transparency. Bankers Almanac's evaluation was based on a set of precise criteria, including the bank's financial performance, solvency, asset quality, adherence to compliance and anti-money laundering standards, and the bank's liquidity. This ranking reflects the National Bank of Yemen's position as one of the leading financial institutions in Yemen, which has achieved remarkable growth in its total assets and deposits, despite the difficult circumstances facing the banking sector in the country. On this occasion, the National Bank of Yemen's management expressed its pride in this achievement, stressing that it embodies the spirit of cooperation and integration between the bank's leadership and employees, and confirms the bank's commitment to providing the best banking services to its customers and contributing to supporting the national economy. This new achievement adds to previous awards received by the National Bank of Yemen, which was honored by the World Union of Arab Bankers with the "Best Bank in Yemen" award for the third consecutive year in 2023, further confirming its distinguished position both locally and internationally. | ||

| 01/05/2025 | ||

Renewing confidence in Dr. Ahmed Bin Sankr as a member of the Board of Directors of the Union of Arab Banks |

||

| The 2025 Arab Banking Conference kicked off in Cairo, the Egyptian capital, under the theme "Partnerships between the Public and Private Sectors to Financing the Economy." On the sidelines of the conference, the Board of Directors of the Union of Arab Banks held its meetings (119th Regular Meeting) and (120th Regular Meeting) in Cairo, Arab Republic of Egypt, on Monday, April 28, 2025. In its 120th meeting, the items of which included the election of a Chairman and Vice Chairman for the formation of the 8th Council, as this was preceded by the formation of a Board of Directors for the 8th session. With reference to what happened in the election, confidence was renewed by electing Mr. Mohamed El-Atrabiy for a second and final term as Chairman of the Union of Arab Banks. Mr. El-Atrabiy holds the position of CEO of the National Bank of Egypt and is one of the prominent banking, financial and economic figures. The membership of Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen, was renewed on the Board of Directors as a representative of Yemeni banks in the eighth session of the new Board for a period of three years ending in 2028. The membership of the members of the new Board of Directors was confirmed as representatives of 20 Arab countries, as the Board witnessed the replacement of 6 new members for 6 Arab countries and the renewal of 41 Arab countries. It is worth noting that the Union of Arab Banks, which is one of the Arab unions operating under the umbrella of the League of Arab States, has many banking tasks and activities that concern the interests of the operating banks included in the membership of the Union. The Union has working relations with most international federations and Arab, regional and international banking, financial and economic institutions and organizations. The Union is active in holding conferences, seminars, workshops and forums held in various countries of the world, as well as holding training courses. The Union has an Arab arbitration center specialized in Arab banks and institutions. The Union of Arab Banks was established on March 13, 1974 and operates under the umbrella of the League of Arab States. The General Secretariat Office is headquartered in Beirut and has offices in Cairo, Riyadh, Khartoum, Socotra and Saba. | ||

| Screenshot of the news | ||

|

||

| Download a pdf copy of th newspaper | ||

|

||

| Ala-ayyam Source link | ||

| 21/06/2024 | ||

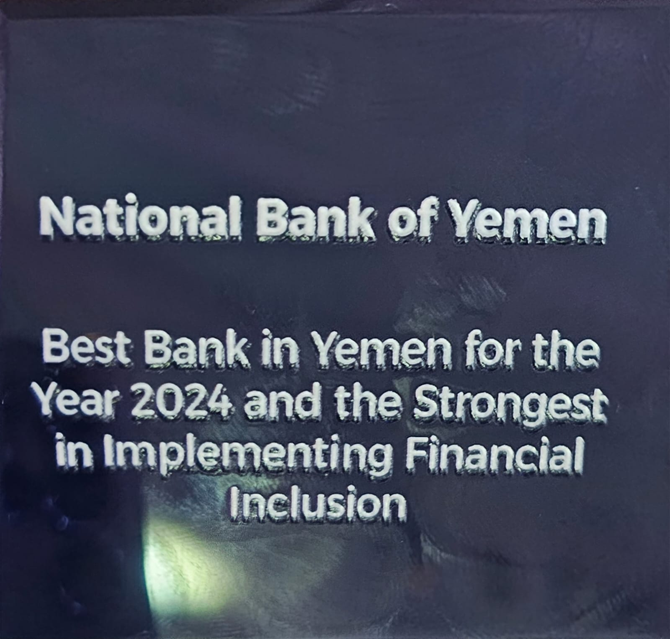

The National Bank of Yemen has been awarded the Best Bank in Yemen Award for the fourth year in a row for 2024, as the best bank in Yemen and the strongest in implementing financial inclusion. |

||

|

||

| The World Union of Arab Bankers (WUAB) honored the National Bank of Yemen for the fourth consecutive year at its annual ceremony held on Wednesday evening, November 20, 2024, in Cairo, Egypt. During the ceremony, the Union's annual awards were distributed to prominent banking figures, distinguished Arab banks, and financial institutions during 2024. Dr. Ahmed Ali Omar Bin Sankrr, General Manager of the National Bank of Yemen, a member of the Board of Directors of the Union of Arab Banks and a member of the International Arab Bankers Union, was honored to receive the Excellence Award as the Best Bank in Yemen and the Strongest in Implementing Financial Inclusion. It is worth noting that the National Bank of Yemen has been recognized for four consecutive years as the Best Bank in Yemen and has received several banking awards in recent years, including the 2021 Arab Banking Achievement Excellence Award for the Best Bank and its excellence in implementing its development and modernization project under exceptional circumstances. The emergence of the National Bank of Yemen at the forefront of Arab banks is a clear indication of what the bank has acquired and distinguished itself with its banking professionalism, experience and trust that characterize a bank with over 55 years of experience in the banking field. It is a clear indication of the capabilities, management and employees of the bank who have achieved numerous accomplishments over decades. How wonderful it is that the slogan of this bank, "experience and trust," is associated with its accomplishments in light of the difficulties facing the banking sector at the national level, at the level of the international banking system and the stages that the economies of countries around the world are passing through. However, the National Bank of Yemen has always proven that it is the Yemeni banking edifice that we can trust and rely on, in all circumstances. We wish the National Bank of Yemen continued success and excellence and to continue providing the best and distinguished services to its customers who have always trusted it due to its experience in the banking market, the security that it enjoys and its fulfillment of all its obligations towards its customers. We congratulate the National Bank of Yemen on these achievements and this distinction that distinguishes it. For his part, Dr. Ahmed Bin Sankrr, the Bank’s General Manager, expressed his great happiness with the continuous excellence of the National Bank, and that this is truly what its employees and members deserve. He wished the Bank to always be honored and distinguished in Arab and international forums, stressing its well-known position among Arab banks and at the international level, and that with this honor, the strength, solidity and position of this leading bank are demonstrated. The Bank’s honoring did not come out of nowhere, but rather from the solidity and strength of its financial position, which is met with appreciation and honored in a manner befitting its position. The Bank has become aiming to achieve this and the best in the future, regardless of the difficulties. On this celebratory occasion, the National Bank congratulates the Prime Minister, Dr. Ahmed Awad Bin Mubarak | ||

|

||

| Source Link | ||

|

||

| The National Bank of Yemen has been awarded the Best Bank in Yemen for the year 2024, for the fourth consecutive year, by the World Union of Arab Bankers in Cairo, Egypt. During a grand ceremony held by the Union to distribute its annual awards to prominent banking figures and distinguished Arab banks, Dr. Ahmed Ali Bin Sankr, General Manager of the National Bank, was honored to receive the Excellence Award as the Best Bank in Yemen and the Strongest in Implementing Financial Inclusion. Dr. Bin Sankr expressed his great happiness with the continued excellence of the National Bank, and that this is truly what its employees and members deserve. He wished the bank to always be honored and distinguished in Arab and international forums, emphasizing its well-established position among Arab banks and at the international level, and that this honor demonstrates the strength, solidity and status of this pioneering bank. The bank's honor did not come out of nowhere, but rather from the solidity and strength of its financial position, which is met with appreciation and honor in a manner befitting its status. The bank now aims to achieve this and to do better in the future, regardless of the difficulties. On this celebratory occasion, the National Bank of Yemen congratulates the Prime Minister, Dr. Ahmed Awad bin Mubarak, the Minister of Finance, Mr. Salem bin Braik, the Bank's Board of Directors, its employees and all its customers on this honor, and for their continuous support to the Bank in achieving successive accomplishments. The National Bank of Yemen has received several banking awards in recent years, including the Excellence Award in Arab Banking Achievement for the year 2021 as the best Yemeni bank with banking experience, professionalism, trust, and a long history spanning more than half a century, proving that it is the Yemeni banking edifice that can be trusted and relied upon in all circumstances. | ||

| Source Link | ||

|

||

| The National Bank of Yemen won the award for Best Bank in Yemen for 2024, for the fourth consecutive year, from the World Union of Arab Bankers, as the best bank in Yemen and the strongest in implementing financial inclusion. The World Union of Arab Bankers honored the winners at its annual 2024 ceremony in Cairo, Egypt. The ceremony was held on Wednesday evening, and the annual awards were presented by the Union to prominent banking figures, banks, and distinguished Arab banks during 2024. Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and a member of the Board of Directors of the Union of Arab Banks and the International Arab Bankers Union, received the Excellence Award for Best Bank in Yemen and the Strongest in Implementing Financial Inclusion. It is worth noting that the National Bank of Yemen has been recognized for four consecutive years as the best bank in Yemen and has received several banking awards in recent years, including the 2021 Arab Banking Achievement Excellence Award for the best bank and its excellence in implementing its development and modernization project under exceptional circumstances. Dr. Ahmed Bin Sankr, the bank's general manager, expressed his overwhelming happiness with the continued excellence of Ahli Bank, describing this as a true honor for its employees and members. He expressed his hope that the bank will always be honored and distinguished at Arab and international forums, emphasizing its well-established position among Arab banks and internationally. He also emphasized that this honor demonstrates the strength, resilience, and stature of this pioneering bank. The bank's recognition did not come out of nowhere, but rather stems from the strength and solidity of its financial position, which is matched by appreciation and recognition in a manner befitting its stature. The bank now aims to achieve this and even greater success in the future, regardless of the challenges. On this celebratory occasion, Ahli Bank congratulates the Prime Minister, Dr. Ahmed Awad bin Mubarak, the Minister of Finance, Mr. Salem bin Braik, and the bank's Board of Directors, its employees, and all its customers on this honor, and for their continued support for the bank's continued achievement. The emergence of the National Bank of Yemen at the forefront of Arab banks is a clear indication of what the bank has acquired and the distinction it has gained through its banking professionalism, experience and trust that characterizes a bank with a long experience in the banking field exceeding 55 years, and a clear indication of the capabilities, management and employees of the bank who have achieved multiple accomplishments over decades. How wonderful it is that the slogan of this bank is associated with experience and trust in what it achieves in light of the difficulties facing the banking sector at the level of the country and at the level of the international banking system and the stages that the economies of the countries of the world are passing through. However, the National Bank of Yemen has always proven that it is the Yemeni banking edifice that we can trust and rely on in all circumstances. | ||

| Source Link | ||

|

||

The National Bank of Yemen has been awarded the Best Bank in Yemen Award for the fourth year in a row for 2024. |

||

|

||

| Cairo/ Special/ October 14: | ||

| The World Union of Arab Bankers (WUAB) honored the National Bank of Yemen for the fourth consecutive year at its annual ceremony held on Wednesday evening, November 20, 2024, in Cairo, Egypt. During the ceremony, the Union's annual awards were distributed to prominent banking figures, distinguished Arab banks, and financial institutions during 2024. Dr. Ahmed Ali Omar Bin sankr, General Manager of the National Bank of Yemen, a member of the Board of Directors of the Union of Arab Banks and a member of the International Arab Bankers Union, was honored to receive the Excellence Award as the Best Bank in Yemen and the Strongest in Implementing Financial Inclusion. It is worth noting that the National Bank of Yemen has been recognized for four consecutive years as the Best Bank in Yemen and has received several banking awards in recent years, including the 2021 Arab Banking Achievement Excellence Award for the Best Bank and its excellence in implementing its development and modernization project under exceptional circumstances. The emergence of the National Bank of Yemen at the forefront of Arab banks is a clear indication of what the bank has acquired and distinguished itself with its banking professionalism, experience and trust that characterize a bank with over 55 years of experience in the banking field. It is a clear indication of the capabilities, management and employees of the bank who have achieved numerous accomplishments over decades. How wonderful it is that the slogan of this bank, "experience and trust," is associated with its accomplishments in light of the difficulties facing the banking sector at the national level, at the level of the international banking system and the stages that the economies of countries around the world are passing through. However, the National Bank of Yemen has always proven that it is the Yemeni banking edifice that we can trust and rely on, in all circumstances. We wish the National Bank of Yemen continued success and excellence and to continue providing the best and distinguished services to its customers who have always trusted it due to its experience in the banking market, the security that it enjoys and its fulfillment of all its obligations towards its customers. We congratulate the National Bank of Yemen on these achievements and this distinction that distinguishes it. For his part, Dr. Ahmed bin sankr, the Bank's General Manager, expressed his great happiness with the continued excellence of the National Bank, and that this is truly what its employees and members deserve, wishing the Bank to always be honored and distinguished in Arab and international forums, stressing its well-known position among Arab banks and at the international level, and that with this honor, the strength, solidity and position of this leading bank appear. The Bank's honoring did not come out of nowhere, but rather from the solidity and strength of its financial position, which is met with appreciation and honored in a manner befitting its position. The Bank has become aiming to achieve this and the best in the future, regardless of the difficulties. On this celebratory occasion, the National Bank congratulates the Prime Minister, Dr. Ahmed Awad bin Mubarak, the Minister of Finance, Mr. Salem bin Braik, and the Bank's Board of Directors, its employees and all its customers on this honor, and for their continuous support to the Bank in order to achieve achievement after achievement. *Sabanet | ||

| Source Link | ||

| 10/06/2024 | ||

The General Manager of the National Bank of Yemen receives regional recognition for his pioneering role in the banking sector. |

||

|

||

| The Union of Arab Banks honored Dr. Ahmed Ali Omar Bin sankr, General Manager of the National Bank of Yemen, a member of the Union of Arab Banks' Board of Directors, and representative of Yemeni banks. Held at the conclusion of the annual forum for compliance managers in Arab banks, the forum was organized by the Union in Sharm El-Sheikh, Egypt, under the title "Enhancing Compliance with Anti-Money Laundering and Counter-Terrorism Financing Legislation and Controls and Ensuring the Protection of Banking Data." The forum was held under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, from June 6 to 8, and was attended by a host of Arab banking leaders and prominent figures. This honor is a culmination of Dr. Ahmed Ali Omar Bin sankr's efforts to enhance compliance and transparency standards in the banking sector, as well as his ongoing efforts to develop and improve banking performance in Yemen, contributing to strengthening financial and economic stability in the country. | ||

Dr. Ahmed bin Sankr, upon receiving the shield of the annual forum of compliance managers in Arab banks, reinforces the efforts exerted in the Yemeni banking sector and its role in combating money laundering and terrorist financing. |

||

| This honor also reflects the high appreciation for his role in representing Yemeni banks in Arab and international banking forums, and his dedication to supporting and keeping up with the latest banking legislation and regulations to combat money laundering and terrorist financing. | ||

| Source Link | ||

| 10/06/2024 | ||

|

||

The General Manager of the National Bank of Yemen, Dr. Ahmed Bin Sankr, has received regional recognition for his pioneering role in the banking sector. He has reinforced the efforts of the Yemeni banking sector and its role in combating money laundering and terrorist financing by receiving the shield of the annual forum of compliance managers in Arab banks. |

||

| The Union of Arab Banks honored Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen, member of the Union of Arab Banks' Board of Directors, and representative of Yemeni banks, with the Sharm El-Sheikh Forum Shield at the conclusion of the annual forum for compliance managers in Arab banks. The forum, organized by the Union in Sharm El-Sheikh, Egypt, was titled "Enhancing Compliance with Anti-Money Laundering and Combating the Financing of Terrorism Legislation and Ensuring the Protection of Banking Data." The forum was held under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, from June 6 to 8, and was attended by a host of Arab banking leaders and prominent figures. This honor is a culmination of Dr. Ahmed Ali Omar Bin Sankr's efforts to enhance compliance and transparency standards in the banking sector, and his continuous efforts to develop and improve banking performance in Yemen, which contributes to strengthening the country's financial and economic stability. It also reflects the high appreciation for his role in representing Yemeni banks in Arab and international banking forums, and his dedication to supporting and keeping abreast of the latest banking legislation and regulations to combat money laundering and terrorist financing. This recognition also serves as a confirmation of the pivotal role played by the National Bank of Yemen in the Yemeni banking market, as it is one of the oldest and largest banks in the country. The bank consistently strives to provide the best banking services to its customers through a wide network of branches spread across Yemen, in addition to offering innovative banking solutions that meet the needs of the local market. The bank has worked to promote financial inclusion by providing convenient banking services to various segments of Yemeni society, including small and medium-sized enterprises. The National Bank of Yemen also stands out for its adoption of community development initiatives, effectively contributing to supporting vital sectors such as education, health, and infrastructure. This approach reflects the bank's commitment to its social responsibility and its efforts to contribute to improving the quality of life for Yemeni citizens. In addition, the bank, under the supervision of the Central Bank of Yemen Headquarters in Aden, seeks to strengthen local capabilities by offering specialized training programs for its employees, contributing to raising the level of competence and expertise in the banking sector. This recognition by the Union of Arab Banks is a recognition by the largest Arab banking group of the National Bank of Yemen's position and its leading role in supporting the national economy. This recognition enhances the bank's reputation both locally and regionally. This recognition also serves as an incentive for the bank to continue to excel and innovate in providing its banking services, and to enhance its role in achieving economic and social development in Yemen. Amid the difficult circumstances facing Yemen, the National Bank of Yemen remains a model of resilience and continuity, continuing to provide high-quality services despite the challenges. This recognition reflects the bank's ability to adapt and evolve in difficult circumstances and supports the bank's ability to achieve sustainability in providing, developing, and diversifying its various banking services, thus enhancing customer and investor confidence in its ability to provide reliable and secure financial solutions. The Union of Arab Banks' recognition of Dr. Ahmed bin Sankr reflects appreciation for the tireless efforts made by the bank and its employees to achieve financial stability and support the national economy. | ||

| Source Link | ||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

| 10/06/2024 | ||

The Union of Arab Banks honors Dr. Ahmed Bin Sankr at the Sharm El-Sheikh Forum |

||

| The Union of Arab Banks honored Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen, a member of the Union of Arab Banks' Board of Directors, and representative of Yemeni banks. Held at the conclusion of the annual forum for compliance managers in Arab banks, the forum was organized by the Union in Sharm El-Sheikh, Egypt, under the title "Enhancing Compliance with Anti-Money Laundering and Counter-Terrorism Financing Legislation and Controls and Ensuring the Protection of Banking Data." The forum was held under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, from June 6 to 8, and was attended by a host of Arab banking leaders and prominent figures. This honor is a culmination of Dr. Ahmed Ali Omar Bin Sankr's efforts to enhance compliance and transparency standards in the banking sector, as well as his ongoing efforts to develop and improve banking performance in Yemen, contributing to strengthening financial and economic stability in the country. | ||

| Source Link | ||

| 09/06/2024 | ||

Conclusion of the annual forum for compliance managers in Arab banks |

||

|

||

| Cairo / Al-Ayyam - Special: | ||

| The annual forum for compliance managers in Arab banks, organized by the Union of Arab Banks in Sharm El-Sheikh, Egypt, concluded. Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and a member of the Board of Directors of the Union of Arab Banks representing Yemeni banks, was honored with the Sharm El-Sheikh Forum Shield at the conclusion of the annual forum for compliance managers in Arab banks. The forum, organized by the Union of Arab Banks in Sharm El-Sheikh, was titled "Enhancing Compliance with Anti-Money Laundering and Counter-Terrorism Financing Legislation and Ensuring the Protection of Banking Data," under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt. | ||

| Source Link | ||

| 09/06/2024 | ||

A major Arab banking honor for Dr. Ahmed Bin Sankr |

||

| Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and member of the Board of Directors of the Union of Arab Banks, representing Yemeni banks, was honored with the Sharm El-Sheikh Forum Shield on Friday, June 8, 2024, at the conclusion of the annual forum for compliance managers in Arab banks, organized by the Union of Arab Banks in Sharm El-Sheikh under the title "Enhancing Compliance with Legislation and Controls for Combating Money Laundering and Terrorist Financing and Ensuring the Protection of Banking Data", under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, during the period from June 6 to 8. | ||

| Source Link | ||

| 09/06/2024 | ||

Dr. Bin Sankr honored with the shield of the Sharm El-Sheikh Arab Banking Forum |

||

| In Sharm El-Sheikh, Egypt, Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and member of the Board of Directors of the Union of Arab Banks, representing Yemeni banks, was honored with the Sharm El-Sheikh Forum Shield. The honoring came at the conclusion of the annual forum for compliance managers in Arab banks, organized by the Union of Arab Banks in Sharm El-Sheikh. The forum, titled "Enhancing Compliance with Anti-Money Laundering and Combating the Financing of Terrorism Legislation and Ensuring the Protection of Banking Data," was held under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, from June 6 to 8. | ||

| Source Link | ||

| In Sharm El-Sheikh, Egypt, Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and member of the Board of Directors of the Union of Arab Banks, representing Yemeni banks, was honored with the Sharm El-Sheikh Forum Shield. The honoring came at the conclusion of the annual forum for compliance managers in Arab banks, organized by the Union of Arab Banks in Sharm El-Sheikh. The forum, titled "Enhancing Compliance with Anti-Money Laundering and Combating the Financing of Terrorism Legislation and Ensuring the Protection of Banking Data," was held under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, from June 6 to 8. | ||

| Source Link | ||

| 08/06/2024 | ||

A major Arab banking honor for Dr. Ahmed Bin Sankr |

||

| Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen and member of the Board of Directors of the Union of Arab Banks, representing Yemeni banks, was honored with the Sharm El-Sheikh Forum Shield on Friday, June 8, 2024, at the conclusion of the annual forum for compliance managers in Arab banks, organized by the Union of Arab Banks in Sharm El-Sheikh under the title "Enhancing Compliance with Legislation and Controls for Combating Money Laundering and Terrorist Financing and Ensuring the Protection of Banking Data", under the patronage of Hassan Abdullah, Governor of the Central Bank of Egypt, during the period from June 6 to 8. | ||

|

||

| 06/05/2024 | ||

The General Manager of the National Bank of Yemen participates in the annual forum of compliance managers in Arab banks in Sharm El-Sheikh. |

||

| At the invitation of the sponsors, the General Manager of the National Bank of Yemen, Dr. Ahmed bin Sankr (a member of the Board of Directors of the Union of Arab Banks), participated today in the opening of the Union of Arab Banks’ annual forum for compliance managers in Arab banks, today, June 6, 2024 AD, in Sharm El-Sheikh, Arab Republic of Egypt - under the title “Enhancing compliance with anti-money laundering and counter-terrorism financing legislation and controls and ensuring the protection of banking data.” | ||

| 29/04/2024 | ||

|

||

| The National Bank of Yemen in Aden holds an awareness lecture on financial inclusion for people with disabilities as part of the Arab Financial Inclusion Day activities. | ||

| Source: Al Ahli Banking Magazine | ||

| As part of the activities of the "Arab Financial Inclusion Day" initiative, launched by the Arab Monetary Fund under the slogan "Towards Encouraging Savings to Promote Financial Inclusion" (April 24-27, 2024), sponsored by the Central Bank of Yemen, Aden Headquarters, the National Bank of Yemen, at its Aden Headquarters (Queen Arwa Branch), in cooperation with the Association for the Physically Disabled, organized an awareness lecture on the importance of financial inclusion. Participants, including people of determination (the physically disabled category), learned about the concept of financial inclusion and how to wisely manage their financial resources and save money to secure their future. The Advisor to the Director General, Mr. Saleh Awad, reviewed the goals and benefits of financial inclusion, how to develop capital, and the importance of saving at the individual and societal levels in the short and long term to achieve desired goals. Participants also learned about the types of savings and appropriate financial investments, and how to foster a culture of saving, given its key role in increasing access to the financial system. For his part, Deputy General Manager for Banking Department Affairs, Mr. Mohsen Saeed Ali Al-Shabahi , delivered a speech welcoming the participants. He emphasized the importance of financial inclusion and the need to promote financial literacy among all segments of society to create a financially aware generation that manages its money properly. He emphasized that people of determination are an important part of the social fabric. He emphasized the keenness of the leadership of the National Bank of Yemen, represented by Chairman of the Board of Directors, Dr. Mohammed Hussein Halboob, and Dr. Ahmed Ali Omar Bin Sankr, General Manager of the National Bank of Yemen, to participate in the Arab Financial Inclusion Day initiative. He explained that the selection of people of determination stems from the National Bank of Yemen's commitment to this segment by providing modern banking services and banking facilities as a form of community contribution to spreading financial awareness among them. He explained that the bank's leadership is keen to keep pace with modern developments by introducing the latest banking programs and systems that meet customer needs and provide them with the highest quality banking services quickly and easily, from anywhere and at any time. The National Bank of Yemen's participation in the Arab Monetary Fund's initiative for Arab Financial Inclusion Day, sponsored by the Central Bank of Yemen Headquarters in Aden, reflects the National Bank of Yemen's commitment to actively participate in this initiative, as well as in all other initiatives and awareness campaigns launched and sponsored by the Central Bank of Yemen. The National Bank of Yemen is one of the first Yemeni banks to target and contribute to educating and raising awareness of the importance of financial inclusion for people with disabilities. At the conclusion of the event, Mr. Mohsen Al-Shabahi, Deputy Director General for Banking Departments, along with Counselor Saleh Awad and Mr. Bassam Madihj, Director of the Marketing Department, opened savings accounts to encourage savings for all 16 participants in this category. An initial sum of 50,000 Yemeni riyals was deposited into their accounts as a form of support and to encourage them to save. For his part, Nasr Nasser Al-Saqqaf, Chairman of the Association for the Physically Disabled, praised the National Bank of Yemen's support for this group of people with disabilities by opening savings accounts for them, providing a comprehensive explanation of the importance of financial inclusion, and introducing them to the bank's services. He considered this a welcome gesture by the leadership and management of the National Bank of Yemen, reflecting their interest in people with disabilities. He called on all banks operating in Yemen to provide further support to people with disabilities, following the example of the National Bank of Yemen's initiative. | ||

|

||

| 25/04/2024 | ||

|

||

| On the occasion of the celebration of the Arab Day for Financial Inclusion, the National Bank of Yemen, head office in Aden, launches an awareness campaign for financial inclusion on its official website. On the occasion of the celebration of the Arab Day for Financial Inclusion under the slogan "Towards Encouraging Savings to Enhance Financial Inclusion", the National Bank of Yemen in the capital, Aden, launches an awareness campaign for financial inclusion through its official website www.nbyemen.com during the period April 24-27, 2024 AD, and also through its branches spread across the various governorates of the Republic. The campaign aims to enhance financial awareness among all segments of society, educate and train children and youth on the importance of saving, educate the public in general about financial management and financial inclusion, and instill sound and purposeful concepts to achieve the slogan of the awareness campaign to encourage saving and enhance financial inclusion in society and work to raise financial awareness in society in order to build a financially responsible generation and enhance the spirit of creativity and initiative and create livelihoods and earning work, as the National Bank of Yemen's plan aims to contribute through several different means, including by launching a group of cultural and financial activities to raise and enhance banking awareness among individuals and encourage them to adopt a culture of saving, investment and personal financial planning, and develop financial skills among people with special needs. Private, youth, the elderly, women, as well as employees and small business owners with serious aspirations for a better future promising goodness and development. | ||

| 27/10/2023 | ||

| For the third year in a row, the National Bank of Yemen wins the Best Bank in Yemen award given by the Arab International Bankers Union. | ||

|

||

| Istanbul / special: | ||

| For the third year in a row, the International Union of Arab Bankers honored the National Bank of Yemen, with its main office in Aden, at the annual ceremony held in Istanbul, Turkey, this evening, Friday, October 27, 2023, at the Intercontinental Hotel, where the bank was awarded the Excellence Award as the best bank in Yemen for the year 2023. During the ceremony, the annual awards granted by the Union to distinguished banking figures, banks and Arab banks during the year 2023 were distributed, as Dr. Ahmed Ali Omar bin Sunkar, General Director of the National Bank of Yemen, member of the Bank’s Board of Directors - and member of the Board of Directors of the Union of Arab Banks, received the Excellence Award as the best bank in Yemen. . For his part, Dr. Ahmed bin Sunkar, Director General of the Bank, expressed his happiness with the distinction of the National Bank of Yemen and taking the award for the third year in a row, and its high standing in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level. Dr. Ahmed Ali Omar bin Sunkar was also presented with the award. The Director General of the National Bank of Yemen presented his membership card and membership card to the Union of Arab International Bankers during the ceremony. The joining of Dr. Bin Sunker to the Union is considered as important as the presence of an experienced and competent Yemeni banking figure who has distinguished himself in the Yemeni banking sector. We congratulate him and the Yemeni banking sector for this trust. It is worth noting that the Arab Organization for Information and Communications Technology awarded the National Bank of Yemen an award as the best bank in excellence for the years 2020-2021 AD, and the International Union of Arab Bankers also granted an award to the National Bank of Yemen as the best bank in Arab banking excellence and achievement for the year 2020-2021, for the first time for two consecutive years, as it was awarded In the year 2021 AD, due to its efficiency and distinction as the best Yemeni bank in that year, as well as grants for the second year in 2022 AD. This is the third year in a row, 2023 AD, that the International Union of Arab Bankers grants the National Bank of Yemen the Excellence Award as the best bank in Yemen, to confirm the bank’s long history and the real appreciation and evaluation it receives from Arab and international financial and banking institutions. The honoring event was attended by members of the Board of Directors of the Union of Arab International Bankers. Members of the Board of Directors of the Union of Arab Banks, as well as Arab and Turkish banking figures, were also attended by His Excellency the Ambassador of the Republic of Yemen to Turkey, Brother Muhammad Saleh Tariq, as well as representatives of Yemeni banks that were honored with other awards according to their banking activity during the year 2023 AD. | ||

|

||

| For the third year in a row, the National Bank of Yemen wins the Best Bank in Yemen award given by the Arab International Bankers Union. | ||

| Istanbul(Sawt Alshaab) special: | ||

| For the third year in a row, the International Union of Arab Bankers honored the National Bank of Yemen, with its main office in Aden, at the annual ceremony held in Istanbul, Turkey, this evening, Friday, October 27, 2023, at the Intercontinental Hotel, where the bank was awarded the Excellence Award as the best bank in Yemen for the year 2023. During the ceremony, the annual awards granted by the Union to distinguished banking figures, banks and Arab banks during the year 2023 were distributed, as Dr. Ahmed Ali Omar bin Sunkar, General Director of the National Bank of Yemen, member of the Bank’s Board of Directors - and member of the Board of Directors of the Union of Arab Banks, received the Excellence Award as the best bank in Yemen. . For his part, Dr. Ahmed bin Sunkar, Director General of the Bank, expressed his happiness with the distinction of the National Bank of Yemen and taking the award for the third year in a row, and its high standing in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level. Dr. Ahmed Ali Omar bin sankr was also presented with the award. The Director General of the National Bank of Yemen presented his membership card and membership card to the Union of Arab International Bankers during the ceremony. The joining of Dr. Bin Sanker to the Union is considered as important as the presence of an experienced and competent Yemeni banking figure who has distinguished himself in the Yemeni banking sector. We congratulate him and the Yemeni banking sector for this trust. It is worth noting that the Arab Organization for Information and Communications Technology awarded the National Bank of Yemen an award as the best bank in excellence for the years 2020-2021 AD, and the International Union of Arab Bankers also granted an award to the National Bank of Yemen as the best bank in Arab banking excellence and achievement for the year 2020-2021, for the first time for two consecutive years, as it was awarded In the year 2021 AD, due to its efficiency and distinction as the best Yemeni bank in that year, as well as grants for the second year in 2022 AD. This is the third year in a row, 2023 AD, that the International Union of Arab Bankers grants the National Bank of Yemen the Excellence Award as the best bank in Yemen, to confirm the bank’s long history and the real appreciation and evaluation it receives from Arab and international financial and banking institutions. The honoring event was attended by members of the Board of Directors of the Union of Arab International Banks and members of the Board of Directors of the Union of Arab Banks, as well as Arab and Turkish banking figures. His Excellency the Ambassador of the Republic of Yemen to Turkey, Brother Muhammad Saleh Tariq, was also present, as well as representatives of Yemeni banks that were honored with other awards according to their banking activity during the year 2023 AD. Your opinion is important to us. Your opinions are important to us, so we hope that readers adhere to the following comment rules: The comment must have a direct connection to the content of the article. To present a new idea or serious opinion and open the door for constructive discussion. It must not include defamation, slander, defamation, insults, or insults. It must not contain any racist, sectarian or sectarian references. It is not permitted to include any commercial advertising in the comment.

Read more : News link |

||

| For the third year in a row, the National Bank of Yemen wins the Best Bank in Yemen award given by the Arab International Bankers Union. | ||

| Istanbul (Alayyam)/ special: | ||

| For the third year in a row, the International Union of Arab Bankers honored the National Bank of Yemen, with its main office in Aden, at the annual ceremony held in Istanbul, Turkey, this evening, Friday, October 27, 2023, at the Intercontinental Hotel, where the bank was awarded the Excellence Award as the best bank in Yemen for the year 2023. During the ceremony, the annual awards granted by the Union to distinguished banking figures, banks and Arab banks during the year 2023 were distributed, as Dr. Ahmed Ali Omar bin Sunkar, General Director of the National Bank of Yemen, member of the Bank’s Board of Directors - and member of the Board of Directors of the Union of Arab Banks, received the Excellence Award as the best bank in Yemen. . For his part, Dr. Ahmed bin Sunkar, Director General of the Bank, expressed his happiness with the distinction of the National Bank of Yemen and taking the award for the third year in a row, and its high standing in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level. Dr. Ahmed Ali Omar bin sankr was also presented with the award. The Director General of the National Bank of Yemen presented his membership card and membership card to the Union of Arab International Bankers during the ceremony. The joining of Dr. Bin Sanker to the Union is considered as important as the presence of an experienced and competent Yemeni banking figure who has distinguished himself in the Yemeni banking sector. We congratulate him and the Yemeni banking sector for this trust. It is worth noting that the Arab Organization for Information and Communications Technology awarded the National Bank of Yemen an award as the best bank in excellence for the years 2020-2021 AD, and the International Union of Arab Bankers also granted an award to the National Bank of Yemen as the best bank in Arab banking excellence and achievement for the year 2020-2021, for the first time for two consecutive years, as it was awarded In the year 2021 AD, due to its efficiency and distinction as the best Yemeni bank in that year, as well as grants for the second year in 2022 AD. This is the third year in a row, 2023 AD, that the International Union of Arab Bankers grants the National Bank of Yemen the Excellence Award as the best bank in Yemen, to confirm the bank’s long history and the real appreciation and evaluation it receives from Arab and international financial and banking institutions. The honoring event was attended by members of the Board of Directors of the Union of Arab International Banks and members of the Board of Directors of the Union of Arab Banks, as well as Arab and Turkish banking figures. His Excellency the Ambassador of the Republic of Yemen to Turkey, Brother Muhammad Saleh Tariq, was also present, as well as representatives of Yemeni banks that were honored with other awards according to their banking activity during the year 2023 AD. Your opinion is important to us. Your opinions are important to us, so we hope that readers adhere to the following comment rules: The comment must have a direct connection to the content of the article. To present a new idea or serious opinion and open the door for constructive discussion. It must not include defamation, slander, defamation, insults, or insults. It must not contain any racist, sectarian or sectarian references. It is not permitted to include any commercial advertising in the comment.

Read more : News link |

||

| Istanbul - Special October 14: | ||

|

||

| 01/06/2023 | ||

| Launching the Banks system service at the National Bank, Al Dhalea branch | ||

|

||

| Aden24 Marwan Hamood | ||

| In the presence of Dr. Muhammad Hussein Halab Major General Ali Muqbil Saleh, Governor of Al-Dhalea Governorate, and Nasser Qayed Muhammad, Director of the National Bank, Al-Dhalea Branch, inaugurated work on the Banks service, as it is considered one of the advanced services that enhances and develops banking work, especially in developing countries, and is considered a standard in providing banking services and facilitating work towards customer service. | ||

| The Governor of Ad Dali inaugurates the Banks system at the National Bank | ||

|

||

| Today, the Governor of Al-Dhalea Governorate, Major General Ali Muqbel Saleh, inaugurated the work of the new banking system (Banks) at the National Bank branch in Al-Dhalea, in the presence of the Chairman of the Board of Directors of the National Bank, Dr. Muhammad Hussein Halboob, and a number of local leaders. During the inauguration ceremony, Governor Moqbel stressed that introducing the new system to the bank is a positive step that creates a competitive atmosphere among local banks, and is considered a shift that will enhance the bank’s successes and advance it at the level of banking services, and reflects the bank’s management’s keenness to provide the best services to the local community. The Governor of Al-Dhalea, speaking during a speech he delivered at the inauguration of the new banking system on Thursday morning, pointed out that the National Bank is one of the pillars of development, and that the governorate is in dire need of development projects that contribute to bringing about developmental and economic recovery in various fields, especially at the level of infrastructure, and that Which improves the living standards of citizens. The Chairman of the Board of Directors of the National Bank also stressed that this new system will provide better services to customers, through centralizing the bank’s databases, which will make it easier for customers to complete their banking transactions in all branches of the bank. Dr. Halboob pointed out that the system accommodates any modern banking services, praising the role of the leadership of the local authority in Al Dhalea in providing all facilities and standing by the leadership of the National Bank. The General Manager of the National Bank branch in Al Dhalea Governorate, Abdel Nasser Qaed, expressed his happiness and all the bank’s employees at the launch of this new system, stressing that this developmental step that the bank is witnessing will be reflected positively in the provision of banking and financial services. The inauguration of the system was attended, in addition to the leadership of the local authority and the National Bank, by the Governorate’s Undersecretary for Organization Affairs, Akram Qassem, the Governorate’s Undersecretary for Investment Affairs, Ghassan Al-Hariri, the Governorate’s Director General of Finance, Abdullah Al-Baidhi, and a number of local figures. | ||

| The Governor of Ad Dali inaugurates the Banks system at the National Bank | ||

|

||

|

||

| Today, the Governor of Al-Dhalea Governorate, Major General Ali Muqbel Saleh, inaugurated the work of the new banking system (Banks) at the National Bank branch in Al-Dhalea, in the presence of the Chairman of the Board of Directors of the National Bank, Dr. Muhammad Hussein Halboob, and a number of local leaders. During the inauguration ceremony, Governor Moqbel stressed that introducing the new system to the bank is a positive step that creates a competitive atmosphere among local banks, and is considered a shift that will enhance the bank’s successes and advance it at the level of banking services, and reflects the bank’s management’s keenness to provide the best services to the local community. The Governor of Al-Dhalea, speaking during a speech he delivered at the inauguration of the new banking system on Thursday morning, pointed out that the National Bank is one of the pillars of development, and that the governorate is in dire need of development projects that contribute to bringing about developmental and economic recovery in various fields, especially at the level of infrastructure, and that Which improves the living standards of citizens. The Chairman of the Board of Directors of the National Bank also stressed that this new system will provide better services to customers, through centralizing the bank’s databases, which will make it easier for customers to complete their banking transactions in all branches of the bank. Dr. Halboob pointed out that the system accommodates any modern banking services, praising the role of the leadership of the local authority in Al Dhalea in providing all facilities and standing by the leadership of the National Bank. The General Manager of the National Bank branch in Al Dhalea Governorate, Abdel Nasser Qaed, expressed his happiness and all the bank’s employees at the launch of this new system, stressing that this developmental step that the bank is witnessing will be reflected positively in the provision of banking and financial services. The inauguration of the system was attended, in addition to the leadership of the local authority and the National Bank, by the Governorate’s Undersecretary for Organization Affairs, Akram Qassem, the Governorate’s Undersecretary for Investment Affairs, Ghassan Al-Hariri, the Governorate’s Director General of Finance, Abdullah Al-Baidhi, and a number of local figures. | ||

|

||

| 24/09/2022 | ||

| For the second year in a row.. The International Union of Arab Bankers awards the National Bank the award for the best bank in Yemen | ||

|

||

| Aden Press / Special | ||

| The International Union of Arab Bankers awarded the National Bank of Yemen the Excellence Award as the best bank in Yemen for developing and providing the latest banking services, at the annual ceremony held Thursday, in the Turkish city of Istanbul. The Bank's General Manager, Member of the Board of Directors of the Union of Arab Banks, Dr. Ahmed Ali Omar Bin Sunkar, received the award that the Bank received for the second year in a row. The National Bank had received the Excellence Award for the year 2021 AD as the best Yemeni bank that distinguished itself in the banking system and digital transformation to implement its strategic project for development, modernization, restructuring, and introducing the new banking system (BANKS) under exceptional circumstances. The emergence of the National Bank of Yemen at the forefront of the ranks of Arab banks is a clear indication of the actual development and modernization it has achieved, resulting in this distinction and ability to compete. The bank's management and employees are credited with having achieved achievements that were witnessed and praised by Arab and international unions. In light of the difficulties facing the banking sector at the country level and at the level of the international banking system and the stages that the economies of countries of the world are going through, the National Bank of Yemen has always proven that it is the Yemeni banking edifice that we can bet on in various circumstances. Dr. Ahmed Bin Sunkar, the Bank’s General Manager, expressed his overwhelming happiness with the distinction of the National Bank and its high status in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level and its strength and solidity... stressing that this honor did not come out of nowhere but through the bank’s annual statements. Which expresses the bank’s right to pay attention to it and the steps for its development and continuous modernization. He added, "The beautiful thing about this is that there are Arab and international institutions that monitor this with a scrutinizing eye and give the bank its right among banks, honor it and put it in the true test of achieving the best year after year." On this festive occasion, the National Bank congratulates the Prime Minister, Dr. Moeen Abdelmalek, the Minister of Finance, Mr. Salem Bin Brik, and the bank’s senior leadership and employees on this honor, and for their continued support for the bank with the aim of achieving the best results and providing the latest banking products. | ||

| For two consecutive years: The International Union of Arab Bankers awards the National Bank of Yemen the award for the best bank in Yemen | ||

|

||

| Yemeni Sport : | ||

| The International Union of Arab Bankers at the annual ceremony 2022 in Turkey in Istanbul, and for the second year in a row, honors the National Bank of Yemen in a large ceremony held on the evening of Thursday, September 22, 2022. During the ceremony, the annual awards granted by the Union to distinguished banking figures, banks, and Arab banks during the year 2022 were distributed. . Dr. Ahmed Ali Omar bin Sanker, General Manager of the National Bank of Yemen - Member of the Board of Directors of the Union of Arab Banks, was honored to receive the Excellence Award as the best bank in Yemen for developing and providing the latest banking services. It is worth noting that the National Bank of Yemen received the Excellence Award in Arab Banking Achievement for the year 2021 AD. As the best Yemeni bank, it excelled in the banking system and digital transformation and was distinguished by its excellence in implementing its strategic project for development, modernization, restructuring, and introducing the new banking system (BANKS) under exceptional circumstances. The emergence of the National Bank of Yemen at the forefront of the ranks of Arab banks is a clear indication of the actual development and modernization it has achieved that has resulted in this distinction and ability to compete, and it is a credit to the management and employees of the bank who have achieved achievements that have been witnessed and praised by the Arab and international unions. How wonderful it is that the slogan of this bank is associated with experience and confidence in what it achieves in light of the difficulties facing the banking sector at the country level and at the level of the international banking system and the stages that the economies of countries of the world are going through. However, the National Bank of Yemen has always proven that it is that Yemeni banking edifice that We can bet on it in various circumstances. We wish the National Bank of Yemen continued success and excellence and to continue providing the best and distinguished services to its customers, who have always trusted it due to its experience in the banking market, the security that characterizes it, and its fulfillment of all its obligations towards its customers. We congratulate the National Bank for these achievements and this unique distinction. For his part, Dr. Ahmed Bin Sanker, General Manager of the Bank, expressed his overwhelming happiness with the distinction of the National Bank and its high status in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level. With this honor, the strength, solidity and stature of this pioneering bank is demonstrated. Honoring the bank has not It comes out of the blue, but through the bank's annual statements that express the bank's right to care for it, the steps for its development, and continuous modernization. The beautiful thing about this is that there are Arab and international institutions that monitor this with a scrutinizing eye and give the bank its right among banks, honor it and put it in the true test of achieving the best year after year. On this festive occasion, the National Bank congratulates the Prime Minister, Dr. Maeen Abdel Malik, the Minister of Finance, Mr. Salem Bin Brik, and the bank’s senior leadership and employees on this honor, and for their continued support for the bank with the aim of achieving the best results and providing the latest banking products. | ||

|

||

| The International Union of Arab Bankers awards the National Bank of Yemen the Best Bank in Yemen award | ||

| Sada Al Sahel-Agencies | ||

| The International Union of Arab Bankers at the annual ceremony 2022 in Turkey in Istanbul, and for the second year in a row, honors the National Bank of Yemen in a large ceremony held on the evening of Thursday, September 22, 2022. During the ceremony, the annual awards granted by the Union to distinguished banking figures, banks, and Arab banks during the year 2022 were distributed. . Dr. Ahmed Ali Omar bin Sunkar, General Manager of the National Bank of Yemen - Member of the Board of Directors of the Union of Arab Banks, was honored to receive the Excellence Award as the best bank in Yemen for developing and providing the latest banking services. It is worth noting that the National Bank of Yemen received the Excellence Award in Arab Banking Achievement for the year 2021 AD. As the best Yemeni bank, it excelled in the banking system and digital transformation and was distinguished by its excellence in implementing its strategic project for development, modernization, restructuring, and introducing the new banking system (BANKS) under exceptional circumstances. The emergence of the National Bank of Yemen at the forefront of the ranks of Arab banks is a clear indication of the actual development and modernization it has achieved that has resulted in this distinction and ability to compete, and it is a credit to the management and employees of the bank who have achieved achievements that have been witnessed and praised by the Arab and international unions. How wonderful it is that the slogan of this bank is associated with experience and confidence in what it achieves in light of the difficulties facing the banking sector at the country level and at the level of the international banking system and the stages that the economies of countries of the world are going through. However, the National Bank of Yemen has always proven that it is that Yemeni banking edifice that We can bet on it in various circumstances. We wish the National Bank of Yemen continued success and excellence and to continue providing the best and distinguished services to its customers, who have always trusted it due to its experience in the banking market, the security that characterizes it, and its fulfillment of all its obligations towards its customers. We congratulate the National Bank for these achievements and this unique distinction. For his part, Dr. Ahmed Bin Sunkar, General Manager of the Bank, expressed his overwhelming happiness with the distinction of the National Bank and its high status in Arab and international forums, which confirms the bank’s position among Arab banks and at the international level. With this honor, the strength, solidity and stature of this pioneering bank is demonstrated. Honoring the bank has not It comes out of the blue, but through the bank's annual statements that express the bank's right to care for it, the steps for its development, and continuous modernization. The beautiful thing about this is that there are Arab and international institutions that monitor this with a scrutinizing eye and give the bank its right among banks, honor it and put it in the true test of achieving the best year after year. On this festive occasion, the National Bank congratulates the Prime Minister, Dr. Moeen Abdulmalek, the Minister of Finance, Mr. Salem Bin Brik, and the bank’s senior leadership and employees on this honor, and for their continued support for the bank with the aim of achieving the best results and providing the latest banking products. | ||

| 22/09/2022 | ||

| Another honor and award for the National Bank of Yemen externally | ||

|

||

| Istanbul “Al-Ayyam” Special: | ||

| The National Bank of Yemen was honored today in Istanbul by the International Union of Arab Bankers, within the Arab Banking Excellence and Achievement Awards for the year 2022 AD, as the best bank in Yemen in developing and providing banking services for the year 2022 AD. | ||

| The award was received by Dr. Ahmed Ali Omar bin sankr, General Manager of the National Bank of Yemen. | ||

| This is not the first award won by the National Bank of Yemen, as it has won several international and Arab awards over the past years. | ||

| Click on the images to see them full size | ||

|

||

| 14/09/2022 | ||

| A press release issued by the Chairman of the Board of Directors of the National Bank of Yemen | ||

|

||

|

||

| On this day, Wednesday, corresponding to September 14, 2022 AD, the Board of Directors of the National Bank of Yemen held its regular meeting No. (4) for the year 2022 AD, and the most important points of the meeting were the discussion of the executive management memorandum on the topic (the foundations of the investment strategy of the National Bank of Yemen, and its areas during the three years coming). In the context of discussing this point, the Mr. Chairman of the Board of Directors explained that the National Bank of Yemen is close to completing the second phase of the project to develop and modernize the National Bank of Yemen in the administrative and banking fields and has made great progress in the field of qualifying and rehabilitating human resources and raising their standard of living and being able to Rehabilitating most of the bank’s buildings, devices, equipment, and means of transportation. Therefore, the National Bank of Yemen is ready to move to the (third phase) of modernizing and developing the bank’s investment areas to expand into the following areas. | ||

|

||

| After extensive discussion by members of the Board of Directors, the Board of Directors approved the following decisions: First: Assigning the executive management to establish precisely defined quantitative and qualitative foundations for the investment strategy during the next three years. It will be submitted to the Board of Directors for the final decision at its November 2022 meeting. Second: The Board of Directors decided that the bank’s investments during the next three years will be concentrated in the following areas: | ||

|

||

| Third: The Board of Directors approved the formation of a higher investment committee consisting of the following: | ||

|

||

| Fourth: The Board of Directors approves contracting with a consulting company (Arab or foreign) for investment consulting and establishing companies | ||

| 29/08/2022 | ||

| Under the patronage of the Governor of the Central Bank of Yemen, the Financial Information Collection Unit organizes a workshop for compliance officials in banks | ||

|

||

| Under the patronage of Mr. Ahmed Ahmed Ghaleb, Governor of the Central Bank of Yemen, and within the framework of efforts made to raise awareness among the Yemeni banking sector in general and compliance officials in banks in particular, the Financial Information Collection Unit organized a workshop entitled (Regulatory Controls to Combat Money Laundering and Terrorist Financing in Banks) operating in various Republic of Yemen) during the period 29 - 30 August of this month. | ||

| وفي اليوم الافتتاحي الأول للورشة، ألقى رئيس وحدة جمع المعلومات المالية، كلمةIn which he welcomed the attendees and compliance representatives in the banks, he also thanked the leadership of the Central Bank of Yemen, the main supporter of the unit, and stressed the need to focus on raising awareness about the crime of money laundering and terrorist financing and how to combat it in accordance with the laws assigned to that. | ||

| On behalf of the Chairman of the National Committee to Combat Money Laundering and Terrorist Financing, Dr. Kamal Al-Subaihi emphasized the importance of banks’ adherence to international standards for combating money laundering and terrorist financing and activating compliance management. He touched on the efforts made by the state to the extent of compliance with the provisions and law of combating money laundering and international recommendations issued by the Financial Action Task Force (FATF). Accordingly, this workshop was organized to train compliance representatives. In banks and familiarizing them with the supervisory controls to combat money laundering and terrorist financing. Deputy Governor of the Central Bank of Yemen, Dr. Muhammad Omar Banaja, in his speech, praised the efforts of the Financial Information Collection Unit, which was able, within a short period of time, to accomplish many tasks at the internal and external levels by signing a number of memorandums of understanding with information collection units in neighboring countries. He also stressed the importance of the commitment of all operating financial institutions. In our country, there are banks, exchange companies, and remittance networks - in accordance with the applicable banking laws, circulars and circulars issued by the Central Bank in order to avoid local and international sanctions that may be imposed on them in the event of a breach of the supervisory controls imposed on them. | ||

| Money and terrorist financing was presented by lecturer Fahd Noman. A detailed explanation of the international, regional and local framework for combating money laundering and terrorist financing in banks was presented by lecturer Bassem Dabwan. It also addressed the quality of notifications and methods of submitting them, which was presented by lecturer Dr. Moaz Mohammed Al-Sayed. | ||

| A team from the National Bank of Yemen attended and participated in the workshop, represented by Mr. Bashir Ali Musleh, Head of the Compliance Unit, Sister Donia Muhammad Nasser, Director of the Risk Department, and Sister Fanar Saleh Ahmed, liaison officer with the Compliance Unit. | ||

| The workshop was characterized by interaction and participation in discussions by compliance representatives of banks operating in the Republic, who in turn appreciated the importance of this workshop and the extent of benefiting from it. . | ||

| 04/07/2022 | ||

| The Deputy Director General for Banking Department Affairs participates in a workshop on the project to support the resilience of the Yemeni economy through the Organization for Economic Cooperation and Development (OECD) in Jordan. | ||

| Oman “AlAhli Banking” follow-ups | ||

| A workshop was held in the Jordanian capital, Amman, on the project to support the resilience of the Yemeni economy, organized by the Organization for Economic Co-operation and Development (OECD) and funded by the European Union. It lasted for two days, July 4-5, 2022, in which a high-level delegation from the Central Bank of Yemen participated, headed by Professor Dr. Muhammad Omar Banaja, Deputy Governor of the Central Bank. The Yemeni Bank, in the presence and participation of the National Bank of Yemen, represented by Mr. Mohsen Saeed Al-Shabahi, Deputy Director General for Banking Department Affairs. The workshop aims to enhance economic flexibility in Yemen in addition to financial inclusion - consumer protection - financial literacy, and holds consultations with relevant stakeholders and develop a vision of the financial situation in Yemen. The Deputy Governor of the Central Bank of Yemen, Dr. Muhammad Omar Banaja during the workshop on the obstacles facing the banking sector and how to deal with them, calling on the European Union to help Yemeni banks by reopening banking transactions for Yemeni banks with European Union banks. Participating on behalf of the Central Bank of Yemen was Mr. Mansour Abdul Karim Rajeh, Undersecretary of the Banking Supervision Sector, and Wadhi Saleh Nasher Al-Omari, Director General of the General Administration of Loans and Foreign Aid. Regarding the Yemeni commercial banks, Mr. Rafiq Saleh Muhammad Al-Qubati, Executive Vice President of the Cooperative and Agricultural Credit Bank, CAC Bank, Farid Muhammad Mamoun from Al-Qutaybi Microfinance Bank, Mahmoud Atta Al-Rifai from Solidarity Bank, and Fikri Abdul Wahab from Aden Microfinance Bank. | ||

|

||

|

||

| Ahmed Bin Sanker (General Director - and Member of the Board of Directors of the Union of Arab Banks) to the World of Banks “Business Journal” | ||

| Ahmed Bin Sanker (General Director - and Member of the Board of Directors of the Union of Arab Banks) to the World of Banks “Business Journal” | ||

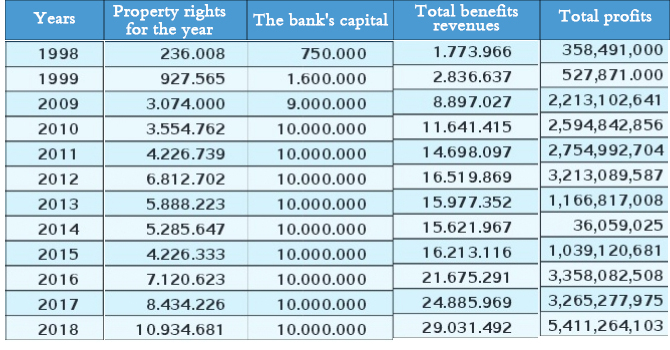

The profits of the National Bank of Yemen during the first half of 2022 reached about 5 billion Yemeni riyals. This problem is still pending today, although the brothers at the Bank of Beirut promised a lot that they would find solutions to this, but so far we have not seen any positive and practical results. Even the small amounts that we reached an agreement with them to pay in stages have only been paid. A small portion does not constitute more than 5%, after which the payment stopped completely. More than a year has passed and they have not paid their existing obligation that must be fulfilled without delay. The banks of Yemen are very upset with the Bank of Beirut’s failure to fulfill its obligations and it is surprising that it has not taken the initiative to pay what is owed and must be paid yet. Since the end of 2019, it has stopped fulfilling its obligations, and this actually creates what everyone did not expect from a transaction issued by a bank like the Bank of Beirut, which we hope will be certain that its relations with Arab banks must be more credible, transparent, and fulfilling its obligations towards them. Bad economic conditions negatively affect the financial and banking conditions in any country, but in Yemen we are trying to find treatments and solutions for our work, develop it, modernize it, and keep pace with what is going on at the regional and international level. The best evidence of this is our attendance at Arab and international conferences and forums organized by the Union of Arab Banks in various Arab countries. European and various countries of the world, the most recent of which was in Frankfurt, known as one of the major financial centers in the world, and our presence in the conference was with the aim of finding new ways of dealing with our Arab problems and the world’s problems that are surfacing and greatly affecting our economies, the last of which was the Ukrainian-Russian war and before that the Covid pandemic. 19, and here we see economists, banks, financiers, businessmen, and financial centers all over the world trying hard to find solutions and remedies to get out of these worsening crises, God willing. Previously, the world was focusing on the crises of third world countries, their life and economic difficulties, and the fragility of their systems, and that they were one of the main causes of the problems of this universe, but the Covid-19 pandemic, and then the Ukrainian-Russian war, came to reveal the fragility of global economies, which are also suffering from deep financial crises that have increased with continuity. The extent of the recent crises has actually revealed to the world the negative indicators that the economies of major countries are suffering from, including the negative indicators (high inflation rates, decline and decline in growth rates, increasing unemployment rates, declining domestic product rates and its impact on countries, and rising commodity prices) meaning that the economies as a whole are suffering from stagnation. Inflationary and these are two problems that came together at one time and timing due to the crises that the world is going through, including the outbreak of wars and various conflicts with the aim of control and domination, but there is always time of financiers and statesmen who seek to find real solutions to get out of these situations and successive crises in the world in general, and I believe Today, it has become necessary for us to find a real partnership with economies capable of growing in the international and global economy for the benefit of everyone on the basis of common interests and not based on the thinking of hegemony and possession.. We continue to keep pace with all the rapid changes and developments that the world surprises us with in terms of modern products and technologies, knowing that we are achieving this development under critical circumstances and an unusual political crisis. Many doubted that we would be able to achieve this breakthrough in such exceptional circumstances, but I believe that the results we have achieved are It is better than what would have been achieved if we were in a period of peace, because our history of dealing with the development of our systems and products before the problems broke out and the Arab and Yemeni Spring was faltering and very slow, but we defied the circumstances and succeeded under difficult circumstances in which we bet on success, and praise be to God, this was achieved for us, with His Almighty permission. . |

||

| Source: Alam almasarif | ||

| Download a copy of the magazine | ||

| Conclusion of a workshop for Yemeni banks and the “SWIFT” group in Cairo To prepare for the payment sector's transition to a new standard, ISO 20022 | ||

|

||